WOID XXI-36

Piss de Resistance

But the rich should take pride in their humiliation, since they will pass away like a wild flower. James 1:10

Babes torn from their mother’s arms. Partners separated from those they love for no other reason than not being born in the same country. You think I’m writing about Trump’s immigration policies, don’t you? Unless you’re some fat cat in the Caymans or one of the nicer arrondissements of Paris, in which case I’m describing the terrible indignities you suffer from letting the US Government see your bank transactions abroad—indignities that, hopefully, a new, more considerate Congress will erase from the law books with the help of the Democratic Leadership, or at least that section of the Democratic Leadership that claims to represent Americans abroad. This is how Corporate Democrats resist Trump? Come on, Man.

America is the only country beside Somalia that asks its citizens living or working abroad to pay taxes on their foreign earnings—make that the only country, because the Somali system is voluntary. Since 1970 the IRS has followed FBAR, the Foreign Bank and financial Accounts Reporting rule, which requires Americans doing business abroad to keep records and make the relevant ones available; starting in 2010 the Feds grew concerned that Americans weren’t volunteering enough, so Congress passed FATCA, the Foreign Account Tax Compliance Act. Basically, FBAR requires individuals living abroad to report liquid investments over $10,000 while FATCA pressures foreign banks to report transactions by American citizens just in case the FBAR rules aren't being followed, otherwise known as “tax evasion.” Also: "bribery," "drug dealing," and so forth.

There’s an old joke that if you send an anonymous note to all the politicians you know with the words The game is up, ninety percent of them will run for their lives. Same for FATCA: once it was voted in all sorts of people started running like roaches when the lights go on. At least one Caribbean nation not primarily known for its beaches found itself unable to pass laws that would force the local banks into compliance. It’s wonderful to see the power of checks and balances in a democratic system: one august member of the local Legislative finally suggested it would be simpler to contact Mr. Trump so Mr. Trump could eliminate FATCA directly—isn’t that how Democracy works in a banana republic? Meanwhile, much has been made of the fact that the number of wealthy Americans giving up their citizenship has increased over the past year: one such is Boris Johnson, the Donald Trump of the United Kingdom. Sounds like a pretty good bill to me.

Naturally, FATCA reform has come up on the radar of the new Trump congress. Unnaturally, FATCA reform has become the uppermost priority of Democrats Abroad, which describes itself as “the official Democratic Party arm for the millions of Americans living abroad.” You’d think the 69% of Americans abroad who supported Sanders over Clinton in the 2016 Primary would have greater priorities than protecting some shady billionnaire’s dealings; not so, according to the leadership of Democrats Abroad, which has been going out of its way to prove to Congress what a terrible burden this FATCA is, to argue that Americans living abroad are being kept from opening accounts; that couples are being split apart, babes torn, etc. With Trump’s election, Democrats Abroad see their chance. Americans abroad who insist in participating in protest marches are warned to be “nonpartisan” because we don’t want to antagonize anybody, do we? And Democrats Abroad has made it their number one priority to launch a campaign to weaken BATCA/FATCA—as one local committee member explained, what did he care for ACA? There’s just that many acronyms a man can handle.

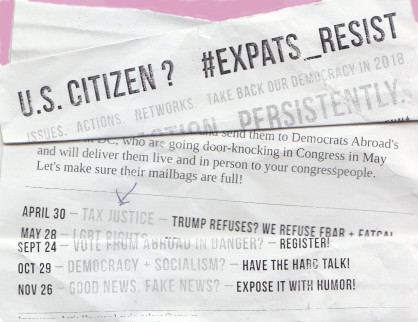

A week ago in Downtown Europe an enthusiastic Yank in a “HILLARY!” baseball cap was handing out a flyer with the following messages:

#EXPATS_RESIST… TAKE BACK OUR DEMOCRACY IN 2018…

APRIL 30 - TAX JUSTICE – TRUMP REFUSES? WE REFUSE FBAR + FATCA:

Naturally I was curious to have explained how one resists a billionaire who refuses to release his tax returns by ensuring all the other billionaires can safely hide their earnings, so I came to the meeting with a few questions. Five people turned up. American #1 explained she was there because in order to sign up at Bank A she’d had to go all the way downtown to their central office. Another pointed out that, actually, she’d opened an account with Bank B, no problem; a third had had no problems with Bank C, but American #4 had suffered the indignity of not having her name on her non-American spouse’s account, not because she’d been denied an account, apparently, but because if she had opened an account in her own name the Feds might have found out what she was up to; after which the whole group sat down to write to their Congresspeople, demanding that this odious burden be removed. There were piles of slickly printed postcards on a table, maybe fifty times more than there were attendees:

The idea was to send these to our representatives, except there was no indication who had paid to print the cards on front or back. It seem Democrats Abroad isn't fond of financial disclosure.

I’m a supportive kind of guy so I thought I’d help my fellow Americans figure things out. American #4 hadn’t mentioned that most all banking in the European Union is done electronically, so the fact that your partner's name alone is on the checking account has little bearing on your ability to use it, nobody’s going to ask you for ID or verify your signature on a paper check because there paper checks are rarely used. In any case, when you send off an electronic check usually you don't have to include your name, or you can change the payer to whomever you want. Money has no smell.

Another complaint against FATCA has been that foreign banks are loath to put up with the paperwork involved and have been known to resist signing up Americans. Then again, banks in many countries are loath to sign up any number of immigrants, or poor people, which is why in the European Union has regulations to ensure that all residents have access to some form of banking, regardless. Of course, the purpose of European bureaucracies (like bureaucracies everywhere) is to discourage citizens from using their rights, non-citizens even more so; this is especially true of the patchwork of conflicting rules and practices that make up the European Union. In that case, then, you’d think the representatives of a progressive party would work with local NGOs and administrations so that the rights denied to rich Americans are not denied to the poor, the migrants, the illegals, either; this would have the benefit of creating good will for Americans abroad as Beacons of Democracy, etc. with the added benefit of helping Americans understand their host culture—isn’t that what travel is supposed to be about? There was a time, many many years ago, when American embassies and consulates made it their priority to foster positive relations and facilitate life for Americans abroad, as opposed to facilitating business deals.

All this I wanted to say. There is a practice in politics known as sheepdogging; you know how a sheepdog runs after the sheep and bumps and barks to make them go in the direction he wants? The sheepdog in residence (more like a Chihuahua, actually) first tried to nudge me toward the postcards and when I asked to speak began to cut me off with barks and threats—for a moment I thought I’d stepped into a Trump rally.

The French, who pretty much invented diplomacy back then, have an expression: mouiller sa poudre, getting your gunpowder wet; this refers to the fact that an army that loads its muskets for the wrong purpose runs the risk of finding the gunpowder’s useless when it’s really needed. In the past few days the Hillbully faction of the Democratic Party have started to pretend they’re going all out against the enemy, to #RESIST! etc. But to #RESIST! what, exactly? And who is the enemy? If you ask me, it’s an awful waste of gunpowder, especially when the guns are aimed in my direction.

May 3, 2017; last revised May 5.